Table of Contents

Definition / general | Essential features | Terminology | Diagrams / tables | Types of budgets | Types of budget planning strategies (budgeting) | Budget process | Financial reporting | Productivity measures and benchmarking | Videos | Additional references | Board review style question #1 | Board review style answer #1 | Board review style question #2 | Board review style answer #2Cite this page: Doan DK, Hassell LA. Laboratory budgeting. PathologyOutlines.com website. https://www.pathologyoutlines.com/topic/labadminbudgeting.html. Accessed April 19th, 2024.

Definition / general

- Budget is a detailed plan outlining expenses (costs) and revenues (incomes); it is also called a financial plan, a map to get where we intend to go

- Budgeting is the process of planning, forecasting, controlling and monitoring the financial resources of an organization (Garcia: Clinical Laboratory Management, 1st Edition, 2004)

Essential features

- Budgeting for the laboratory should include operating costs based on past experience and projected changes in both fixed and variable costs, and be monitored regularly (usually monthly)

- Capital budgets should be managed separately from operating budgets

- Where possible, profitability should be monitored as a measure of laboratory efficiency; in the absence of accurate revenue numbers, other metrics of efficiency can be used

Terminology

- Expense (cost) is the money spent on supply, labor, overhead or on a product or service (Travers: Clinical Laboratory Management, 1st Edition, 1997)

- Capital costs are investments on building, land, new equipment and innovations

- Operating costs are the expenses to produce products or services, such as reagents, supplies, maintenance, transportation or equipment rental

- Personnel costs include employee salary, raises, benefits and training fees

- Overhead costs refer to expenses that are not directly related to billable tests; these could be management, utilities, advertising and rent

- Revenue (income) is the money a lab receives for its services or products

- Income is categorized by the source of the activity; for the laboratories, this could be inpatient, outpatient, research or outreach testing (Lab Med 2003;34;515)

- (Net/gross) margins = [(net/gross) revenues - (net/gross) expenses]/revenue

- Variance is the difference between the predicted / planned budget and actual revenues and expenses

Diagrams / tables

- Costs can be classified in different ways as shown in the following tables (McPherson: Henry's Clinical Diagnosis and Management by Laboratory Methods, 23rd Edition, 2016):

Direct Indirect (overhead) Variable Fixed Salary Nonsalary Operating Capital Reagents ~ ~ ~ ~ Proficiency testing ~ ~ ~ ~ Analyzer service ~ ~ ~ ~ Analyzer ~ ~ ~ ~ Testing staff ~ ~ ~ ~ Management staff ~ ~ ~ ~ Rent ~ ~ ~ ~

Sample laboratory budget

Reference: Lab Med 2003;34;515Description Current actual Current budget Variance % Variance Inpatient charges

Outpatient charges

Total revenues$246,958

$1,574,862

$1,821,820$219,370

$1,476,560

$1,695,930$27,588

$98,302

$125,89012.6%

6.7%

7.4%Salary - professional

Salary - technical regular

Salary - technical overtime

Total salary$36,484

$50,548

$9,438

$96,470$35,213

$53,030

$2,610

$90,853$(1,271)

$2,483

$(6,828)

$(5,617)-3.6%

4.7%

-261.6%

-6.2%General lab supplies

Reagents

Lease, rentals

Total supplies$24,546

$130,356

$2,070

$156,972$19,476

$75,464

$2,070

$97,010$(5,070)

$(54,892)

$0

$(59,962)-26.0%

-72.7%

0.0%

-61.8%Total expenses $253,422 $187,863 $(65,579) -34.9%

Types of budgets

- Operational budget provides a plan of day to day expenses and revenues

- Capital budget provides a plan for long term upgrades and improvements, such as buying a new building or equipment (Chron: Differences and Similarities of Capital and Operational Budgeting [Accessed 23 May 2022])

Types of budget planning strategies (budgeting)

- There are several ways of budgeting; these include (but are not limited to) the following: pro forma budgeting, zero based budgeting, priority based budgeting, activity based budgeting and flexible budgeting (CFI: The Four Main Types of Budgets and Budgeting Methods [Accessed 23 May 2022])

- The following table compares 2 commonly used budgeting strategies: pro forma versus zero based budgeting

Pro forma budget (incremental) Zero based budget - Build a new budget plan based on the previous or historical budget data

- Simple to prepare

- More commonly used

- Does not encourage cost effectiveness because it is based on assumptions that preexisting operations are essential

- Build a new budget plan from scratch

- More complex to prepare

- Less commonly used; typically used to propose a new service, laboratory section or test

- Encourages cost effectiveness

Budget process

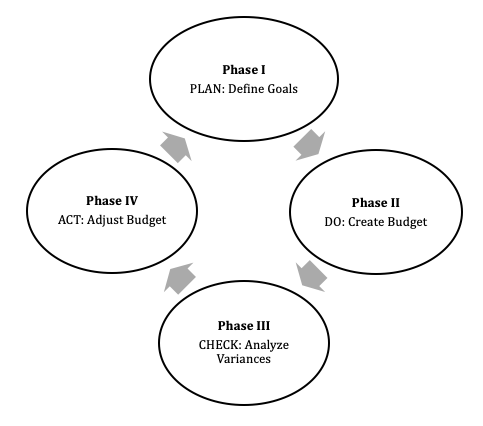

- We recommend using the Plan, Do, Check, Act cycle for budget process and management

Contributed by Duy K. Doan, M.D.

- Phase I - Plan: define goals

- Clear goals and objectives guide resource allocation

- Senior management usually sets these, although departments can get involved

- Phase II - Do: create budget

- Review the past

- Collect statistical data of past revenue, expenses, margins and volumes (for pro forma budget)

- Evaluate the present

- Assess new programs, expanded programs, reduced or discontinued programs

- Review key influential factors, such as politics, economy and technology

- Predict the future

- Predict new revenues, expenses and margins

- Predicting future = past performance + estimated changes

- Predicting revenues can be hard; you need to estimate the lab growth rate

- Lab growth rate = existing client growth + new clients - lost clients

- Predicting expenses may also be challenging; this requires both a prediction of lab growth rate and careful justifications

- Capital expenses:

- Why do we need this new equipment?

- Is it the best?

- How much does it cost?

- What is the return on investment (ROI)?

- Defined as net income of an investment divided by its cost

- Personnel expenses: evaluation of current workload and productivity

- Are there any expected changes in workload, productivity, staff scheduling and new or expanded programs in the future?

- Operating expenses change proportionately with the number of tests: expected costs = current spending + lab growth rate

- Review the past

- Phase III - Check: analyze variances

- Review monthly for variances (Garcia: Clinical Laboratory Management, 2nd Edition, 2013)

- Favorable budget variance refers to positive variances, showing gains; unfavorable budget describes negative variance, indicating losses

- Try to explain any significant variances from budget

- Phase IV - Act: adjust budget

- Make adjustments in order to meet the goals

Financial reporting

- Budget, as discussed earlier, is the internal reporting tool that management uses to control expenses and makes decisions; the budget variance analysis is performed periodically, at least monthly

- Labs also need to report their business information to external entities, such as government agencies, stakeholders and banks; these external reports are called financial statements

- There are 3 major financial statements that reflect a lab's business activities and profitability for each accounting period; these statements are balance sheet, income statement and statement of cash flows

- These statements are reported yearly (Gitman: Principles of Managerial Finance, 10th Edition, 2002)

- Balance sheet: shows what a lab owns (assets), what a lab owes (liabilities) and its net worth (equity); the balance sheet carries over from year to year

- Investors analyze the balance sheet for indication of management's effectiveness in using debt and assets to generate revenue

- Income statement: also called the profit and loss statement; shows revenues and expenses over a period, which is typically a fiscal year

- Income statement starts from zero at the beginning of the new fiscal year

- Investors use the income statement to assess whether the lab is generating profits or losses

- Cash flow statement: summarizes the movement of cash that comes in and goes out of a lab in a period; the cash flow statement highlights how well a lab generates cash

Productivity measures and benchmarking

- Productivity is the ratio of what is produced (product or service) to what is required to produce it (labor and supplies)

- Important terminology in productivity calculation is full time equivalent (FTE):

- FTE is a metric that measures the total number of full time employees you have based on hours worked, rather than the exact number of employees (e.g., an employee who works full time is equal to 1 FTE, while an employee works half time would be equivalent to 0.5 FTE)

- Common productivity measures for clinical laboratories are billable tests / paid FTE, billable tests / worked FTE, worked FTE / paid FTE, labor cost / billable test, supply cost / billable test, overtime / worked straight time

- Benchmarking is a practice to compare an organization's performance / productivity to a standard; benchmarking helps management to:

- Identify problem areas in its own organization

- Learn better practice from other laboratories (Lab Med 2008;39;108)

- Benchmarking can be internal or external:

- Internal benchmarking compares productivity within a laboratory

- External benchmarking compares a laboratory's productivity to that of other laboratories in the market

Videos

Financial management:

effective budgeting in the laboratory

- Ian McNeal, CPA

Additional references

Board review style question #1

Your lab medical director decides that it is time to purchase this new piece of equipment in order to change the way the lab handles certain samples. The manufacturer quotes you a price tag for the system of $140,000, with an associated maintenance contract of $7,000 to cover service during the first year of ownership. Which of the following statements is true?

- Capital budget should include the instrument cost plus the first year of maintenance

- If savings from the new method matched the added operating cost, net lab profit margins would not change

- Operating budget would increase by $7,000, less any savings in personnel costs gained by shifting to the new methodology

- Your operating budget would include an amortized portion of the $140,000 purchase cost

Board review style answer #1

C. Operating budget would increase by $7,000, less any savings in personnel costs gained by shifting to the new methodology. Operating budgets include supplies, labor and equipment maintenance expenses. Net profit margins would be reduced since this calculation includes fixed costs, such as capital equipment.

Comment Here

Reference: Laboratory budgeting

Comment Here

Reference: Laboratory budgeting

Board review style question #2

Which of the following is a legitimate operational variable cost to consider in the lab operating budget?

- Employee search and recruitment expenses for a new lab director

- Fuel surcharges associated with incoming shipments of reagents

- Housekeeping expenses associated with needing a clean room for PCR

- Lab information system upgrades

- Lab website and order entry system upgrade

Board review style answer #2

B. Fuel surcharges associated with incoming shipments of reagents. Operational expenses include reagent costs and associated variable shipment charges, along with other materials needed to provide results and service. All the other expenses are associated with administrative overhead and would not vary based on the number of tests performed.

Comment Here

Reference: Laboratory budgeting

Comment Here

Reference: Laboratory budgeting